3GPP has defined the main 5G Standalone (SA) and non-standalone (NSA) options. Standalone (SA) deployments are based, namely in options 2, 4, 5, and 7. In Non-Standalone (NSA) option 3x, the LTE carrier aggregation and NR-LTE dual connectivity are already supported. In NR deployment with Option 2, the NR is a standalone but isolated carrier. In SA Option 4, the Operator can extend the NR carrier using Dual Connectivity, by adding an LTE carrier. By accessing LTE carriers in addition to NR carriers, Option 4 allows the NR users to achieve a competitive user data rate.

The introduction of SA Option 4 will, however, require some extra development work for vendors. Although functions such as idle mode, and RRC connection set-up, need no further adaptation, several tasks like handover may be impacted. A couple of new procedures are also required, for example, secondary node addition and removal. It is expected that extra testing work for suppliers and operators is needed to introduce Option 4. However, in practice, many functions are not impacted by option 4, such as the idle mode and handover procedures, which can be implemented via option 2.

Option 4 will require some extra configuration data. Configuration of parameters controlling the activation and deactivation of secondary LTE node, Xn-based LTE-NR neighbor relationship and Xn link are needed to support dual connectivity. An alternative to option 4 to achieve higher data rates is to have DSS on all carriers. In this case, the drawback is that extra baseband resources are needed for both NR and LTE. Another alternative, when no 5G Core services are required, is on-demand NSA fallback handover.

Option 4 challenges

According to NGMN and GSMA papers, Operators agreed on developing options 4, 5 & 7 without specific prioritization between them. Several operators, such as AT&T and Telstra, have now given up on this request. SKT still sees a need for Option 4. Regarding the vendor ecosystem, Ericsson is against Option 4 development as they promote DSS as an alternative. Nokia has made no commitment yet, and Huawei provided initial commitment but with no official roadmaps.

Regarding UE chipsets, Qualcomm seems to be against development, while Mediatek planned support in their roadmap, but recently dropped the feature due to lacking network implementations to test against. Implementing Option 4 will require significant Operator efforts in driving vendor support. Otherwise, some Operators will face a difficult decision on a costly deployment of DSS on most of their LTE carriers. Only pressure by Operators is likely to persuade prominent vendors to develop this feature. The outcome is yet uncertain due to the terminal situation following the ‘chicken and egg’ approach. Will the terminals drive the support of SA Option 4, or Option 4 should be pushed by the Operators to drive the terminal industry?

MNOs could clarify to the vendors that Option 4 implementation will commence, using DSS selectively, even if option 4 is not supported by a supplier. This could provide an incentive for the remaining suppliers to develop Option 4 to match user data rates. The extent of DSS and the use of on-demand NSA selection should ultimately remain a decision that will help respond to competitive pressures from other operators when appropriate.

Option 4 timescale

Option 4 support is not expected until 2022 at the earliest. Small scale deployments of SA are expected to occur earlier in 2H 2021, and mainstream deployment might happen in 2022. Option 2 will be used for any SA deployments taking place before Option 4 is available. Detailed mitigation measures to address the lack of Option 4 support will depend upon the use case and each deployment scenario. The use of DSS or on-demand NSA fallback handover are both options that can be explored. In case DSS is used, sites are then likely to remain on Option 2 rather than migrating to Option 4 for the mainstream SA introduction.

Supplier Support

In case Option 4 is not supported by any supplier, Operators will face a decision for a costly activation of DSS on more carriers, leading to additional carrier deployments (3.5 GHz AAUs) due to spectral efficiency reduction. Total costs for all the sites would run to hundreds of millions. The other alternative is using on-demand NSA fallback, which may not actually improve user experience. The Operators should accept reduced data rates for the SA users in the near term before the spectrum can be re-farmed to NR. This could postpone the mainstream introduction of SA in some or all of the network until NR-supporting terminal market penetration. This will enable most of the carriers to be switched directly from LTE only to NR only. The most likely outcome is that Operators will postpone the mainstream use of SA in urban areas until a high penetration of NR-supporting terminals is reached, probably by 2025 or even later.

A significant fraction of NR terminals may not experience low-band NR deployment benefits until SA is fully introduced. Operators could push for early support of low-low ENDC combination support to minimize the number of impacted terminals. Selective SA usage in rural areas can be considered. Still, a solution for voice mobility would be needed, such as keeping voice users on SA in urban areas or using EPS fallback.

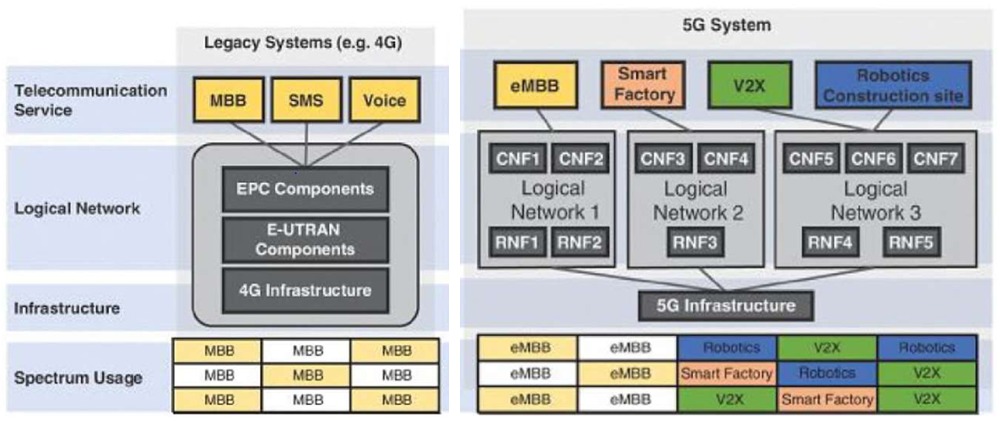

Option 4 and 5G SA core

5G core services like FMC, slicing & distributed UPF will not be available for basic mainstream eMBB services. 5G Core use is possible for non-mainstream services that accept a reduced SA user data rate compared to NSA or operate in a limited area, making DSS affordable. NR dependency on LTE is prolonged, increasing the risk of facing evolution constraints for NR, such as fast access to a low latency bearer for the mainstream eMBB user.

The Operators should, therefore, continue planning for earlier smaller scale 5G Core deployment in 2021-2023. By supporting campus deployments and preparing the terminal and network support for the later switchover to SA, the Operator will be well placed to respond to competitive pressure in deploying SA early, using an appropriate DSS usage level.

Lack of Option 4 will probably delay the overall mainstream introduction of 5G SA in most networks. This will, in turn, make SA data rates uncompetitive to NSA deployments and existing LTE architecture. On the other hand, developing SA Option 4 will increase NR’s support in the terminal base, allowing carrier re-farming from LTE to NR and bring the MNOs a step closer to 5G SA deployments and support of advanced 5G services.