Abstract:

This article provides an in-depth examination of the latest CBRS (Citizens Broadband Radio Service) base station deployment strategies and their real-world implications, with a particular focus on the recent data analysis report from the recent CBRS SAS analysis report (NTIA Report 23-567) of January 2023 published by NTIA and ITS. The research addresses a gap in understanding regarding the actual delivered speeds and the limitations of current CBRS base station configurations.

Introduction to CBRS

The Citizens Broadband Radio Service (CBRS) is a regulatory framework established by the U.S. Federal Communications Commission (FCC). It permits the dynamic sharing of up to 150 MHz of the 3.5 GHz spectrum band among diverse users.

CBRS has emerged as an innovative solution for network congestion, coverage gaps, and the ever-growing demand for high-speed data.

CBRS is designed to facilitate efficient use of the spectrum by dynamically allocating available frequencies to users, thus mitigating interference and optimizing bandwidth utilization. A unique aspect of CBRS is the implementation of Spectrum Access System (SAS), a sophisticated frequency coordination system, which manages the interactions between different tiers of users to avoid interference.

The benefits of CBRS extend beyond efficient spectrum utilization. It provides a cost-effective solution for service providers to expand and enhance their network coverage, especially in densely populated or remote areas. Additionally, CBRS has paved the way for private LTE and 5G networks, offering businesses the opportunity to build and manage their own high-speed, low-latency networks. This has significant implications for industries like manufacturing, logistics, and healthcare, where reliable and secure wireless communication is crucial.

Regulatory and Policy Implications

The Citizens Broadband Radio Service (CBRS) operates within a unique regulatory framework that is sectioned into three tiers of shared spectrum access:

- Incumbent Access: which primarily consists of entities like the U.S. Navy, holds the highest priority for spectrum usage. Across numerous locations nationwide, the incumbents’ engagement with the band is relatively minimal, thereby limiting their influence over other users.

- Priority Access License (PAL): belongs to users that purchased spectrum licenses during CBRS auctions. A user can purchase a 10 MHz channel but is limited to a cap of four 10 MHz channel licenses.

- General Authorized Access (GAA): with the least priority, is available to unlicensed users when the spectrum is not in use by incumbent or PAL users. GAA users can access up to 80MHz of the spectrum, and potentially the entire 150MHz if higher priority users are absent in the same geographic area.

Figure 1: CBRS frequency map and priority tiers

However, the regulatory landscape and policy implications of such a model warrant further examination. Policymakers and regulators need to understand how this shared spectrum model impacts competition, innovation, and the digital divide.

On one hand, CBRS’s dynamic spectrum sharing could stimulate competition by providing more organizations access to valuable spectrum. On the other hand, the complexities and uncertainties associated with sharing spectrum might deter some potential users.

Moreover, while the CBRS model has been successful in the United States, its applicability and scalability in other countries with different regulatory environments and market conditions is another area for exploration.

Lastly, the impact of CBRS deployment on the digital divide is another critical consideration. CBRS could potentially be a tool to increase broadband access in underserved areas, given its suitability for fixed wireless access deployments.

However, the data and insights derived from the analysis of CBRS base station deployment and performance can help inform whether this technology is indeed serving this purpose and how its potential could be fully harnessed to bridge the digital divide.

CBRS Base Station Deployment

Deployment strategies

CBRS base station deployment strategies have been an essential factor in the successful integration of this technology into wireless communication ecosystems. There is a high degree of variability in these strategies, as evidenced by the data from the recent CBRS SAS analysis report (NTIA Report 23-567) of January 2023 published by NTIA and ITS. The strategies are shaped by numerous factors, such as the particular use case, the geographical region, and the specific requirements of the network.

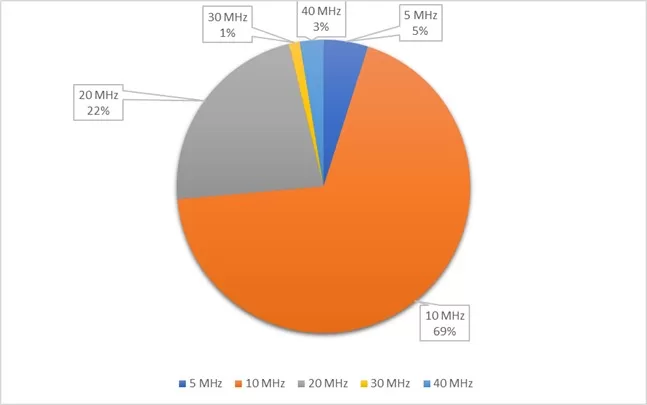

A significant insight from the report, as illustrated in Figure 2, shows that a vast majority of active the CBRS base stations operate with bandwidths of either 10 MHz or 20 MHz. This suggests a balanced approach to network management, where service providers are optimizing the available spectrum to achieve a trade-off between data throughput and coverage.

Figure 2: Percents of active grants by bandwidth at the date of January 2023

The deployment trends also reveal a strong preference for outdoor base stations, with high-power Category B devices being the most common. These trends could be driven by the need for wide area coverage and robust signal strength, especially in urban and suburban areas where network congestion is a common issue.

Another notable trend is the high proportion of General Authorized Access (GAA) devices in the CBRS ecosystem. This indicates a broader participation by general users in the CBRS band, highlighting the inclusive nature of this technology.

Figure 3: Numbers of CBSDs (thousands)

Finally, there is a diverse mix of technologies being deployed in the CBRS band, including 4G, 5G, and other proprietary technologies from vendors like Cambium and Tarana. This technological diversity signifies the adaptability of the CBRS band to accommodate different types of wireless communication systems.

Performance Metrics

Evaluating the performance of Citizens Broadband Radio Service (CBRS) base stations is instrumental in understanding the capabilities and potential of this innovative technology. The performance of these base stations is shaped by a variety of key metrics.

One of the key factors influencing CBRS base station performance is the implementation of Multiple Input Multiple Output (MIMO) technology. MIMO leverages multiple antennas at both the transmitter and receiver ends, allowing for spatial multiplexing, which increases spectral efficiency and capacity while improving resilience against fading and interference.

| Performance Metrics | 2×2 MIMO | 4×4 MIMO | 8×8 MIMO | 16×16 MIMO |

| Max. Theoretical Throughput (Mbps) | 100 | 200 | 400 | 800 |

| Estimated Real-world Throughput (Mbps) | 80 | 160 | 320 | 640 |

| % of Total CBRS Base Stations | 80% | 10% | 7% | 3% |

Table 1:CBRS Base Stations Performance Metrics

Higher order MIMO configurations, such as 4×4, 8×8, and 16×16, allow for more parallel data streams and, consequently, higher data rates. However, increasing the number of antennas brings additional complexity and requires advanced signal processing techniques, such as precoding and channel estimation, to mitigate inter-stream interference.

terms of real-world network performance, the aggregate throughput of a standard CBRS base station does not typically exceed 100 Mbps. Although this figure may appear modest compared to theoretical maxima, it is vital to recognize that actual network conditions introduce a variety of factors that may curtail the actual throughput. These factors encompass control signaling overheads, interference, and fluctuations in channel conditions, all of which can impact the efficiency of data transmission.

The data analysis report published by the National Telecommunications and Information Administration (NTIA) and the Institute for Telecommunication Sciences (ITS) unveils a distinct segmentation in the types of technologies currently deployed within the CBRS band. The report indicates that 42% of the technologies deployed are 4G, 6% are 5G, with the remaining 52% composed of other technologies. This diverse technology blend underscores the versatility of the CBRS band to accommodate different generations of wireless communication systems, each offering unique performance characteristics.

Future Potential and Opportunities

The analysis of CBRS base stations’ deployment and performance gives us a glimpse into the future potential of this technology.

While the current CBRS base station deployment is dominated by 4G technology (42%), there is a growing shift towards 5G (6%), indicating an evolving technological landscape. The potential of CBRS in facilitating the deployment of 5G networks, particularly in providing mid-band spectrum, could be explored.

The expansion of use-cases for CBRS base stations beyond traditional telecommunications is another potential area for exploration. For instance, the use of CBRS in private networks for industries like manufacturing, logistics, and agriculture or its application in delivering wireless broadband in rural or underserved areas.

With the ongoing advancements in wireless technology, the share of 5G systems in CBRS deployments is expected to increase. 5G brings the promise of ultra-reliable, low-latency communications (URLLC), and massive machine type communications (mMTC), expanding the use cases for CBRS far beyond traditional mobile broadband.

The evolution of MIMO configurations in CBRS base stations, from the majority being 2×2 and a few 4×4 to vendors exploring 8×8 and even 16×16 configurations, highlights the continuous innovation in this space. These advanced MIMO configurations could unlock higher throughputs and more efficient spectrum utilization, paving the way for new applications and services.

The careful study of its deployment strategies, performance metrics, and growth trends offers valuable insights for network operators, equipment vendors, and policymakers as they navigate the evolving landscape of wireless communications.

Conclusion

While the majority of the current CBRS base station deployments are 4G, the emerging presence of 5G points to the evolving direction of this technology. The continuous advancements in MIMO configurations highlight the ongoing innovation in this space, promising higher throughputs and more efficient spectrum usage.

Despite its complex regulatory landscape, the CBRS framework offers significant potential for expanding wireless communication, particularly for underserved areas, and enabling new applications beyond traditional telecommunications. As CBRS continues to grow and evolve, it stands as a vital player in the future of wireless communication technology.