Introduction

Over the next few years, hundreds of millions of consumers worldwide will have a new option for broadband access: fixed wireless. A combination of additional spectrum, advances in network equipment and CPE, and the advent of 5G are helping to transform fixed wireless access (FWA) from a broadband option of last resort into a viable competitive alternative in certain markets.

In some countries already served by fiber- and cable-based fixed broadband (FBB) systems, FWA could offer a competitive alternative, possibly with faster service and lower prices. In areas that are un-served or under-served, FWA has the opportunity to provide communities with the type of broadband service they require for the 21st century.

What is FWA?

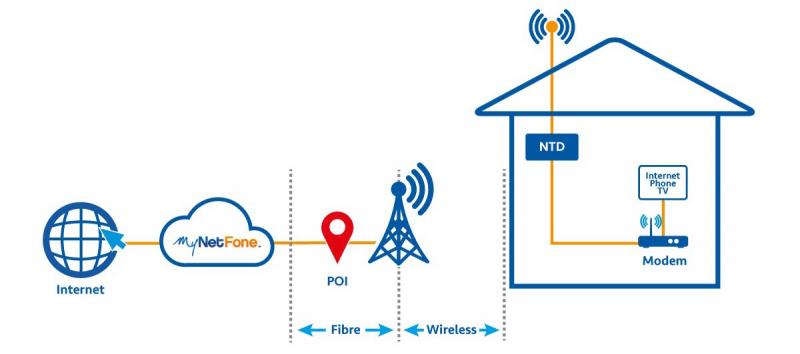

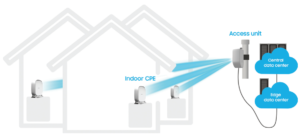

FWA, Fixed Wireless Access, is a concept for providing broadband service to homes and SMEs that is particularly attractive in cases where there is no infrastructure in place to deliver wired broadband via copper, fiber, or hybrid solutions. It can also be used when the existing infrastructure is not able to provide sufficient service.

FWA Concept (Samsung)

FWA solution using LTE has been around for many years but its speed is not nearly as fast as other high-speed broadband solutions such as fiber. Fortunately, with the introduction of 5, high-frequency millimeter waves (mmWaves) above 6GHz, the speed of FWA is now comparable to fiber. In addition, technology advancement has made even below 6GHz spectrums more feasible for fixed wireless by applying massive MIMO technologies. Using below 6GHz band, wider coverage can be achieved which makes it suitable to cover rural areas.

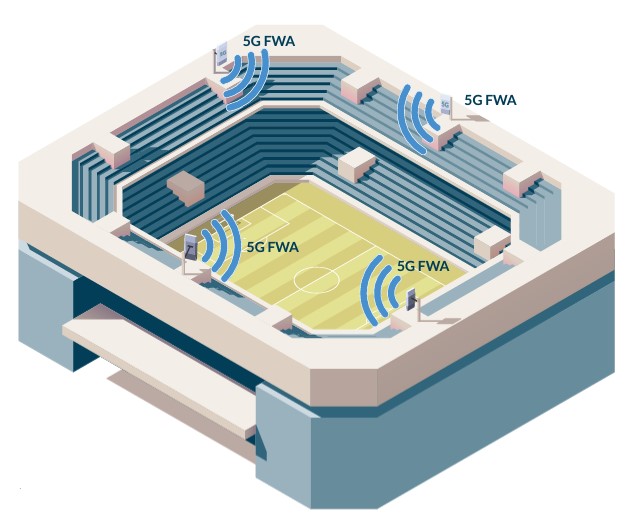

With 5G due to provide 10 to 100 times more capacity than 4G, it has the potential to enable cost-efficient FWA solutions on a massive scale.

Why FWA?

- Compared with fiber-to-the-home (FTTH) and other wireline solutions, FWA offers a variety of benefits including the significantly lower rollout costs, rapid service rollout, and lower OPEX. This is because the bulk of the costs and most of the complexity involved in fixed access deployments are associated with the last mile: the portion of the network that reaches the user premises.

- FWA also offers an opportunity to double the impact of a 5G deployment by addressing the two prominent 5G use cases – MBB (Mobile Broadband) and fixed wireless – simultaneously.

- The 5G beams that serve mobile users outdoors during the daytime can be redirected to an FWA terminal when people return home in the evening, thereby strengthening the case for 5G deployment and its outlook as an affordable and sustainable technology.

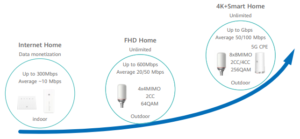

- Fiber Like Experience, With the help of 4.5G and 5G technologies, FWA offers up to Gbps broadband experience, helping operators provide fiber-like broadband services.

4G and 5G FWA Experience Evolution

- In many situations, FWA– based on 4G, or 5G – may be the only feasible broadband access option, particularly in rural areas and emerging markets with limited fixed infrastructures, which comprise the majority of homes around the globe.

- Fast Development, Fiber to the Home needs a long time to obtain the permission of RoW and considerable civil work, which further

prolongs the deployment process, However, FWA does not need to obtain RoW permission and is easy to install, reducing the Service

activation time to only 1 or 2 days.

Civil Work for Fiber Deployment

The Business Case for FWA

The business case for FWA is most favorable in the following situations:

- In dense urban markets, mmWave provides a good alternative, especially in cities with only one good FBB provider, and where FTTH is under-built and/or costs are high. It’s obvious that the opportunities tilt toward the United States more than most countries in Western Europe, where fiber-based solutions are less expensive to build and broadband services are more competitive and less expensive. In markets with two or more good FBB providers, the FWA case is more challenging, as taking subscribers would have to come from a significantly better service or lower price.

- In lower-density urban/dense suburban scenarios, mmWave falls off where it’s not economically viable to build sites within 0.5 km of the household. But the expected availability of 3.5 GHz spectrum (which can reach up to 14 km when using the right CPE) will make FWA viable in sub- 6 GHz spectrum for both 5G and LTE in many markets. The best markets for FWA based on the mid-band spectrum are where there is decent density.

- Low-density suburban/rural markets. Historically, these are the areas traditionally underserved or unserved by FBB. Wireless Internet Service Providers (WISPs), using an unlicensed spectrum, have been successful in some of these areas. The opportunity for licensed FWA in these areas is more case by case. The service must work with mainly lower band LTE spectrum, in conjunction with some mid-band build-out in areas where there is a ‘cluster’ of homes, such as a village. Clearly, the case for wireless is most compelling in areas where the existing FBB infrastructure is sub-par and/or lacks a compelling roadmap.

Ovum forecasts that LTE-based FWA will account for 40% of all fixed wireless broadband subscriptions by 2022, with 5G FWA accounting for a further 16%.

Fixed wireless access growth by technology, 2016–2022

FWA industry case studies

A variety of operators around the world are using fixed wireless technology to provide broadband connectivity, often under various market conditions, and across a diverse range of business models.

4G FWA

- In the Czech Republic, T-Mobile offers a fixed broadband replacement service using its cellular 4G LTE network. The network incorporates 4×4 MIMO and tri-band carrier aggregation to deliver capacity for a range of TV, FMC, and multiplay services. Outdoor-mounted CPE supports LTE connections of up to 600Mbps downlink and 150Mbps uplink. The operator is also currently rolling out massive MIMO on its

network. - In Ireland, Imagine offers its rural “LTE fiber speed broadband” fixed wireless access service using its LTE-A network coupled with fiber to the base station. The company says its service is community-driven the greater the demand, the higher the priority given to network rollout in a local area).

5G FWA

Carriers and startups are beginning to extend their 5G fixed wireless access offerings across the U.S. as they roll out new services in 2020.

-

Verizon 5G fixed wireless access market

In June, Verizon restarted its broadband FWA program, known as 5G Home. The operator kicked off its sixth 5G fixed market in parts of Detroit on June 10 and plans to have 10 cities up on 5G FWA by the end of 2020. Verizon originally started a nonstandard 5G fixed service in October 2018. The company currently offers standard 5G FWA based on the 3rd Generation Partnership Project (3GPP) in parts of Houston, Los Angeles, Indianapolis, and Detroit.

- Startups such as Starry and Common Networks are starting to offer 5G service in some U.S. cities, using microwave and mmWave wireless to serve broadband to businesses and apartment buildings.

- In the UK, 5G FWA is a definite rival to xDSL and it is also faster and cheaper than cable and low-speed fiber plans.

Conclusion

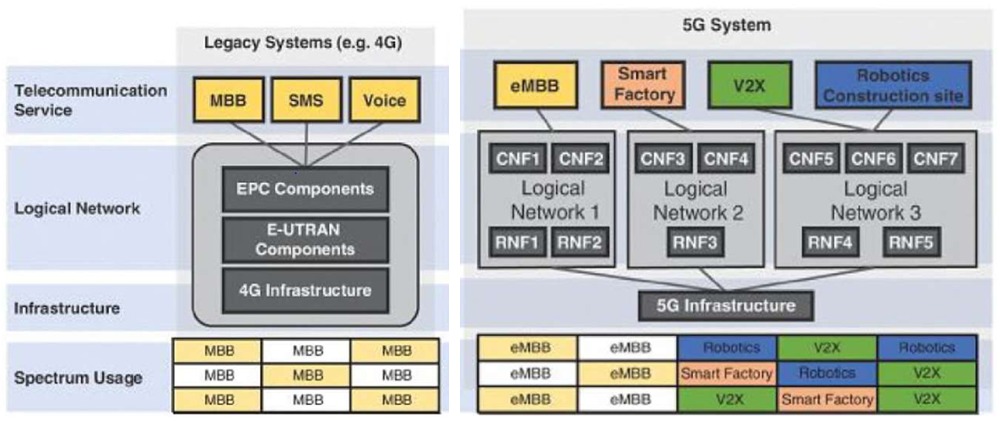

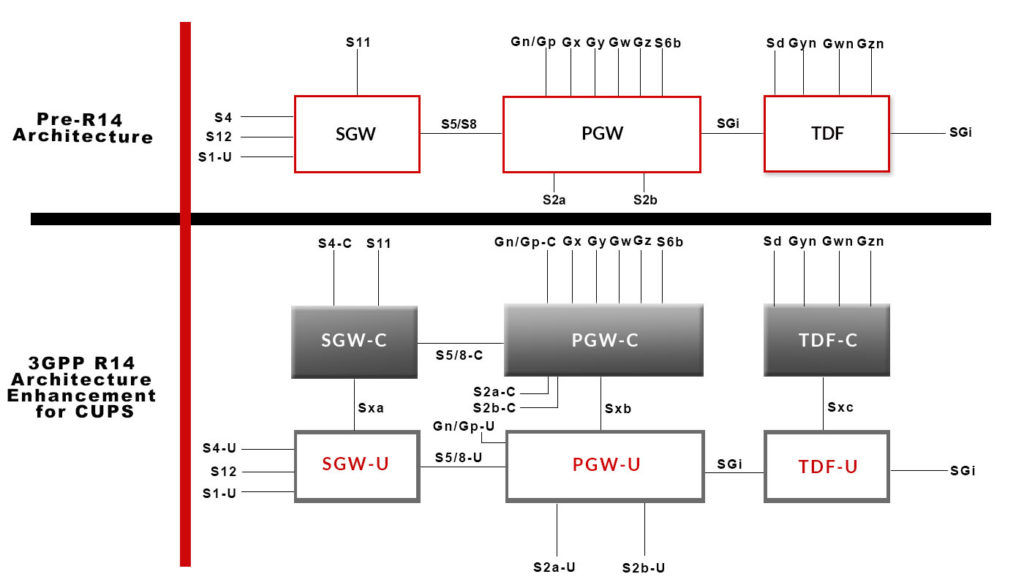

Key technology enablers such as beamforming and new frequency bands, in combination with advances in mobile back and front hauling, network virtualization, and network programmability are strengthening the FWA concept significantly.

While the exact characteristics of any FWA deployment are case-specific, So the market suggests that 5G-based FWA is definitely an option to fulfill the advanced future service requirements of the homes and SMEs of tomorrow in many types of environments around the globe.

With 5G, we have the opportunity to achieve true network convergence, since the same technology and indeed the same infrastructure can be used to provide next-generation MBB, IoT, and FWA.

References

- Samsung, 5G FWA white paper.

- Huawei, 4G/5G FWA Broadband white paper.

- Ovum, 5G Wireless Home Broadband white paper.

- Ericsson, FWA in Reality

- Nokia, 5G Fixed Wireless Access opportunity for mobile operators