Smartphones and mobile telephony have already radically changed the way we communicate and consume. More and more people around the globe are now using their mobile devices to complete several tasks and transactions. The new 5G wireless communication network is expected to aid in this direction. 5G will further transform the way we communicate and transact, while at the same time, ensure economic growth for various industry sectors. The insurance industry is one of them.

5G and Insurance Industry

5G will enable better assessment and risk prevention across different insurance sectors. Medical examinations, diagnoses, and treatments will become much faster and more efficient, while super-advanced coverage and protection can be offered to the property and car insurance industries.

5G is expected to increase data transfer speed three times more than existing networks and even up to ten times faster under specific circumstances. But apart from speed, it can also carry and store a much more considerable amount of data. Thus, functions that until now required supercomputers will be able to be carried out through small devices, anywhere and anytime without delays. This means we will see new digital services that are today considered non-existent to emerge in the international markets.

New 5G services

5G portable devices (wearables) that measure everything from blood sugar to heartbeats will collect vast amounts of data in uninterrupted time. This data can be sent directly to medical institutions. Treatment efficiency, either interventions or medications, will be multiplied because scientists will now have a significant amount of evidence and cases in their hands. 5G wearables are expected to help each of us monitor and take care of our own health.

Besides, 5G ultra-speeds will allow a patient’s history to be quickly loaded so that doctors can provide immediate assistance, especially in emergency situations. Of course, for real-time or critical communications 5G will have to ensure the appropriate service efficiency, data rates, and coverage. Medical files should be downloaded without any problems, and any content should be streamed in real-time without a hitch.

If everything goes as planned, it is estimated that in the next decade, 5G will disrupt various industries and create 22 million jobs worldwide. It will also generate 3.5 trillion dollars in direct economic activity and fuel sustainable long-term growth worldwide.

5G for health insurance

In the insurance industry, monitoring or examining a person’s health, even through wearables, will be feasible. The insurance company will be able to collect a lot of data fast, process it equally fast, and deal with the insured or prospective insured person accordingly. It will propose a new contract or improve the existing one’s coverage, offer discounts, or check claims. Insurance companies are already preparing to provide premium discounts to those who lead a healthy lifestyle and will be able to prove it through technology.

But technology doesn’t stop there. If someone is far from home and needs an urgent operation, he will be able to be operated on by artificial intelligence robots in a local hospital. These robots will just have to follow the instructions given by the surgeon by video call.

As insurers are now aiming to offer not just a typical health contract, but extensive wellness and support services, 5G may prove to be a valuable ally.

5G for property insurance

Of course, the property management industry will not be left unaffected either. Today a smartphone can communicate with several smart home appliances. 5G, however, will enable direct communication between these smart devices themselves, resulting in the 5G Internet of Things.

For example, the refrigerator will be able to “update” the oven that the meat has been thawed in order to preheat it. Most useful, however, is that the oven itself will be able to “alert” its owner that it is switched on. The owner can then choose to allow or switch off from a distance. In the event of a fire, it will even be able to alert the insurer and collect valuable information such as photos, to facilitate the compensation process. The more information each insured customer has, the better it will be able to calculate risk and help prevent it. 5G IoT will be able to do this job and help reduce costs.

5G for commercial insurance

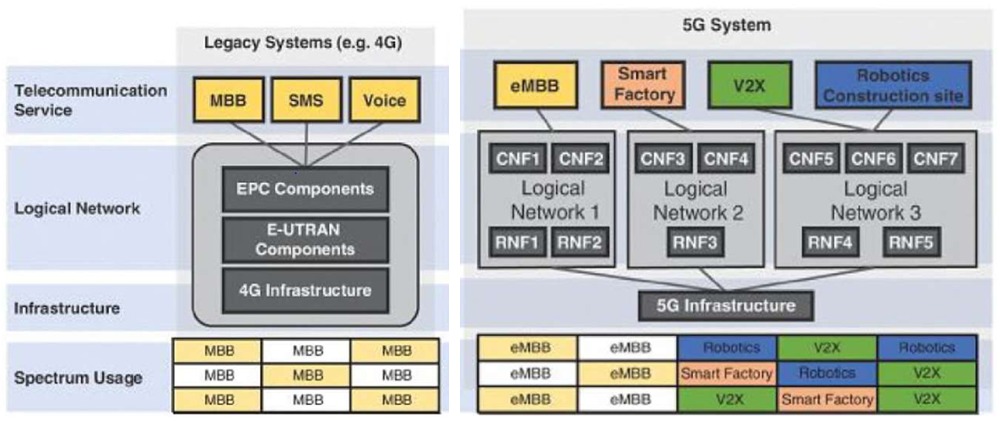

In commercial insurance, cargo transportation can be monitored real-time, while drones will travel longer and show more. Factories will turn into “smart factories” where artificial intelligence will predict, diagnose, and repair. That is, 5G will help perform risk assessment and prevention.

5G for auto/vehicle insurance

Finally, in conjunction with the introduction of autonomous electric vehicles on the roads, the landscape in the automotive industry is also expected to change. Premiums will be falling as these vehicles are considered safer. They will be able to communicate with each other to avoid accidents and utilize up-to-date road maps to alert about traffic.

5G and Insurance companies transformation

5G will affect all industries from construction to distribution and services with the aim to improve living conditions across the globe. But most importantly, even the most time-consuming processes will run much faster, making companies much more flexible. Thanks to the valuable data that will be constantly gathered, they will be able to adjust products and the services they provide continuously. This will, in turn, help them to meet their clients’ needs better.

What should companies do now? Rather than simply fearing this enormous challenge, they have only to find ways to adapt to the new reality. For example, to seize the opportunities offered by the latest technology and expand the services they offer to the customer, that is, to become a valuable ally in facilitating his day-to-day life.

Most insurance companies seem to have already caught up with what is going on and are moving towards this direction. For the ones that will not embrace the changes, it will be difficult to keep up with the market needs. Let’s see what the future will hold.